IRMAA is an often-overlooked Medicare surcharge that can significantly increase your healthcare expenses in retirement.

Healthcare expenses can represent one of the largest categories of expenses for retirees—even if you’re eligible for Medicare. In fact, new findings from the Employee Benefit Research Institute (EBRI) project that retired couples who are Medicare beneficiaries may need to set aside more than $400,000 to cover medical expenses in their golden years.

As people live longer and medical costs continue to rise, managing healthcare expenses is becoming an increasingly critical aspect of retirement planning. This is especially true once you become eligible for Medicare, as your income can meaningfully affect your premiums if it exceeds certain thresholds.

That’s why it’s essential to understand what IRMAA is, so you can plan accordingly for this often-overlooked Medicare surcharge. By carefully managing your taxable income as a Medicare beneficiary, you can minimize the potential impact of IRMAA on your retirement budget, preserving more of your hard-earned nest egg for other retirement goals and expenses.

WHAT IS IRMAA?

IRMAA, which stands for Income-Related Monthly Adjustment Amount, is an additional charge that applies to Medicare Part B and Part D premiums for individuals whose income exceeds certain thresholds.

IRMAA is meant to have higher-income Medicare beneficiaries pay a larger portion of the total cost of coverage. The amount of the adjustment varies based on income, with the IRS establishing income brackets each tax year.

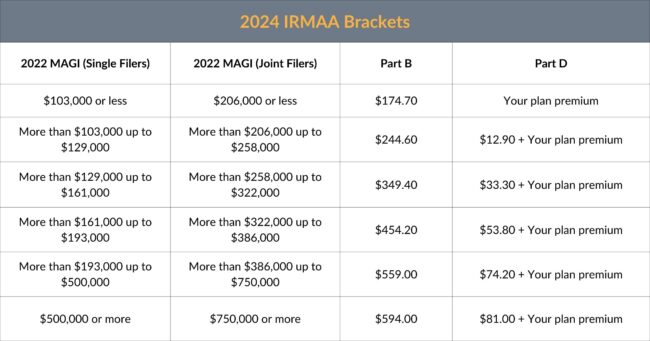

In 2024, for example, the standard Medicare Part B monthly premium is $174.70. However, beneficiaries subject to IRMAA may see their monthly premiums increase to as much as $594. Meanwhile, IRMAA can increase Part D premiums by as much as $81 each month.

Generally, as your income increases, so does the amount of your IRMAA. Thus, careful planning is crucial to effectively manage your taxable income and overall healthcare expenses in retirement.

HOW IS IRMAA CALCULATED?

The Social Security Administration (SSA) looks at your income from your tax return two years prior to the current year to determine who owes IRMAA. For example, your potential IRMAA surcharge for 2024 would be based on the income you reported on your 2022 federal income tax return.

The SSA then uses its own modified adjusted gross income (MAGI) calculation to determine if you exceed the income threshold and, if so, how much your surcharge will be.

To calculate your Medicare-specific MAGI, start with your Adjusted Gross Income (AGI) on your tax return. Then, add the following:

- Tax-exempt interest that you’ve earned or accrued (e.g., municipal bond interest).

- Interest from U.S. Savings Bonds you used to pay for higher education.

- Any income you earned while living abroad that was excluded from your gross income.

- Income from Puerto Rico, American Samoa, Guam, and/or Northern Mariana Islands, which is not otherwise included in AGI.

Below are the income brackets for 2024. Keep in mind these thresholds can change from year to year based on the inflation rate.

Source: SSA.gov

WHO MUST PAY IRMAA?

If you must pay IRMAA, the Social Security Administration (SSA) will let you know by sending you a letter. Here’s how the process works:

- When you enroll in Medicare, you pay the standard Part B and D premiums.

- If your income exceeds the IRMAA thresholds, the SSA will send you a pre-determination notice.

- If you believe the information that the SSA sends you is inaccurate, you have 10 days to dispute the notice.

Otherwise, the SSA will follow up with an initial determination notice within a few weeks of sending the pre-determination notice. The determination notice has largely the same information as the pre-determination notice but also outlines an appeals process.

To appeal the IRMAA decision, you must file Form SSA-44 and prove that your tax return was either out of date or inaccurate. You can also appeal to the SSA to lower or eliminate your IRMAA payment if you experience a life-changing event that significantly lowers your income, such as retirement, marriage, divorce, death of a spouse, or loss of income-producing property. In either case, you’ll need to provide documentation to support your claim for a new determination.

STRATEGIES TO AVOID PAYING IRMAA

Individuals who enroll in Medicare Part B (which covers doctor services, outpatient care, medical supplies, and preventive services) and/or Medicare Part D (prescription drug coverage) and have a MAGI above the specified levels set by the SSA must pay IRMAA. Fortunately, there are a variety of strategies you can leverage to lower your taxable income, thereby minimizing the Medicare surcharge or avoiding it altogether.

#1: STRATEGIC INCOME PLANNING

By effectively planning and managing your income in retirement, it’s possible to keep your MAGI within certain limits to avoid paying IRMAA. Generally, this involves strategically balancing withdrawals from taxable, tax-deferred, and Roth accounts to minimize your taxable earnings.

It’s also important to manage your required minimum distributions (RMDs) once you reach RMD age, as these distributions can increase your MAGI. If you don’t need the extra income, you might consider making a qualified charitable distribution (QCD) from your IRA, which can satisfy your RMD and charitable giving goals without increasing your taxable income.

#2: GIVE STRATEGICALLY

Strategically planning your charitable donations is another way to minimize your taxable income in retirement and potentially avoid the IRMAA surcharge. Consider the following strategies:

- Qualified Charitable Distributions (QCDs). The IRS allows individuals to transfer up to $100,000 annually directly from an Individual Retirement Account (IRA) to a qualified charity through a Qualified Charitable Distribution (QCD). This amount can satisfy all or part of your RMD but doesn’t count as taxable income, thereby helping you avoid triggering IRMAA surcharges.

- Front-Loading Charitable Distributions to a Donor-Advised Fund (DAF). With a donor-advised fund (DAF), you can make a large, tax-deductible charitable contribution in one year, potentially bringing your income below IRMAA thresholds for that year. You can then direct grants to charities over time, satisfying your giving goals in subsequent years.

- Bunching Charitable Contributions. Taxpayers who itemize deductions can consider “bunching” multiple years’ worth of charitable contributions into a single tax year. This can help you exceed the standard deduction limit and provide a significant itemized deduction, lowering your income in years when it might exceed IRMAA thresholds.

By incorporating strategic charitable giving into your financial planning, you can achieve your philanthropic goals, manage your taxable income, and potentially mitigate or avoid IRMAA surcharges in retirement. Be sure to consult with a financial professional to identify the strategies that best suit your financial objectives.

#3: USE MARKET FLUCTUATIONS TO YOUR ADVANTAGE

While no one enjoys down markets, they often provide opportunities to strategically lower your taxable income in retirement so you can avoid paying IRMAA. For example, executing a Roth conversion in a negative market environment may allow you to lower your immediate tax burden while setting the stage for future tax-free withdrawals.

With a Roth conversion, you pay taxes on the amount you convert in the year you make the conversion. By converting invested funds in a down market, when their market value is likely lower, you can reduce the amount of tax you owe on the conversion. Furthermore, converting during a downturn also means a greater potential for tax-free growth once the market recovers, which can provide you with additional financial resources in your golden years.

Market fluctuations can also help facilitate tax-loss harvesting, a strategy that involves selling investments at a loss to offset capital gains tax liability on other investments. If your realized losses exceed your realized gains in a given tax year, you can use up to $3,000 of those losses to offset your taxable income and potentially avoid or lower your IRMAA payment.

PLANNING FOR THE HIGH COST OF HEALTHCARE IN RETIREMENT

Understanding and planning for IRMAA is a crucial aspect of managing healthcare costs in retirement. By being proactive about your taxable income and employing strategic financial planning, you can potentially reduce or even avoid the additional charges associated with IRMAA, thereby preserving more of your retirement savings for other goals and obligations.

Sloan Advisory Group can help you tailor these strategies to your specific financial situation, so you can navigate the complexities of Medicare premiums with confidence. Contact us to develop a personalized financial plan that helps you maximize your financial resources and secure a financially stable retirement.