Last month, news stories noted it’s the 10th anniversary of the financial crisis of 2008. It was a time when everyone saw their investments drop, and no one was sure where the bottom would be. In that climate, financial fears were understandable.

But it begs the question: Are we still holding on to that fear from a decade ago? Does it bias us, and affect our ability to see our options clearly and make solid financial plans?

I have had people come into my office, still talking about what happened 10 years ago. And as a result, they still have their money in cash. Unfortunately, that meant they missed out on one of the greatest bull markets of our time.

The fact is, if you sold back in 2008, you would’ve taken a big loss. But if you stayed in the market, you would have much more now than you did 10 years ago.

Understanding Your Financial Fears

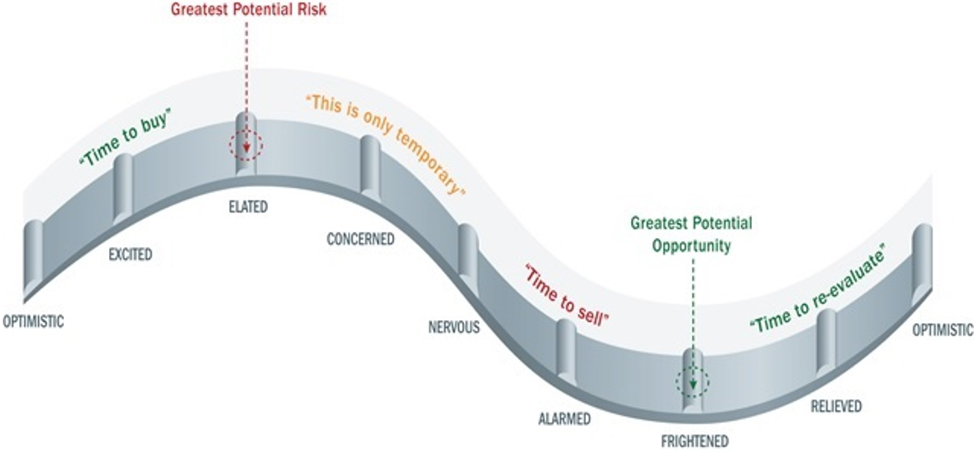

As a Certified Financial Planner, I know firsthand that investing is closely tied to our emotions—specifically, a cycle of emotions that can sometimes be misleading. When the market is soaring, you’re apt to think “Wow, things are really great. I should be investing right now!” But those good feelings might mean you’re witnessing the height of the market; is that really the best time to invest?

On the flip-side, people are likely to feel the most fear and concern at the bottom of the market, which can be a smart time to buy. But because a low point doesn’t feel good, it can stop us from spotting a good opportunity.

When it comes to investing, fear can be a great paralyzer, keeping us in the same place instead of moving us forward. You might have financial fears of making the wrong decision. Of losing everything by investing in the next Lehman Brothers. Of not knowing enough about how different financial instruments work.

There may also be fear of being taken advantage of by a professional, particularly if you’ve had a bad experience in the past. Or if you’re a worrier by nature, money matters could be just one more arena where you’re waiting for the other shoe to drop.

Yet fear can cause us to self-sabotage. Ask yourself: Where would I be if I didn’t have these fears? What would my investment strategy look like?

How to Allay Your Financial Fears

As an investor, you really have to have a sense of optimism about the future; a realization that smart investing is a matter of patience and time. I once had a client worried about changes she was about to make in her business, and the fears she had about taking this step.

I posed the following question to her: “If you had $3 million in your bank account right now, what would you do?” The emotions that came up around the question—matters of comfort and safety, and a certain absence of fear— really made her think. It was the one question that helped propel her forward with her plans, since she recognized fear was the single thing holding her back. Is our fear rational?

So often, that is the question: What would we do if we weren’t sidelined by fear? As a financial adviser, I wear many hats. Along with explaining different investment options, and counseling clients about what strategy will best suit their needs, I help them explore their own concerns and emotions related to money.

Understanding your fears but not letting them sabotage you is the best way to proceed in investing with confidence and clarity.

If you are interested in joining one of our Conversation Circles and want to learn more about mindset and money, please get in touch.