Investment opportunities exist all around the globe—and it’s hard to know where next year’s best returns will appear.

A globally diversified portfolio can help capture a broad range of returns and deliver more reliable outcomes over time.

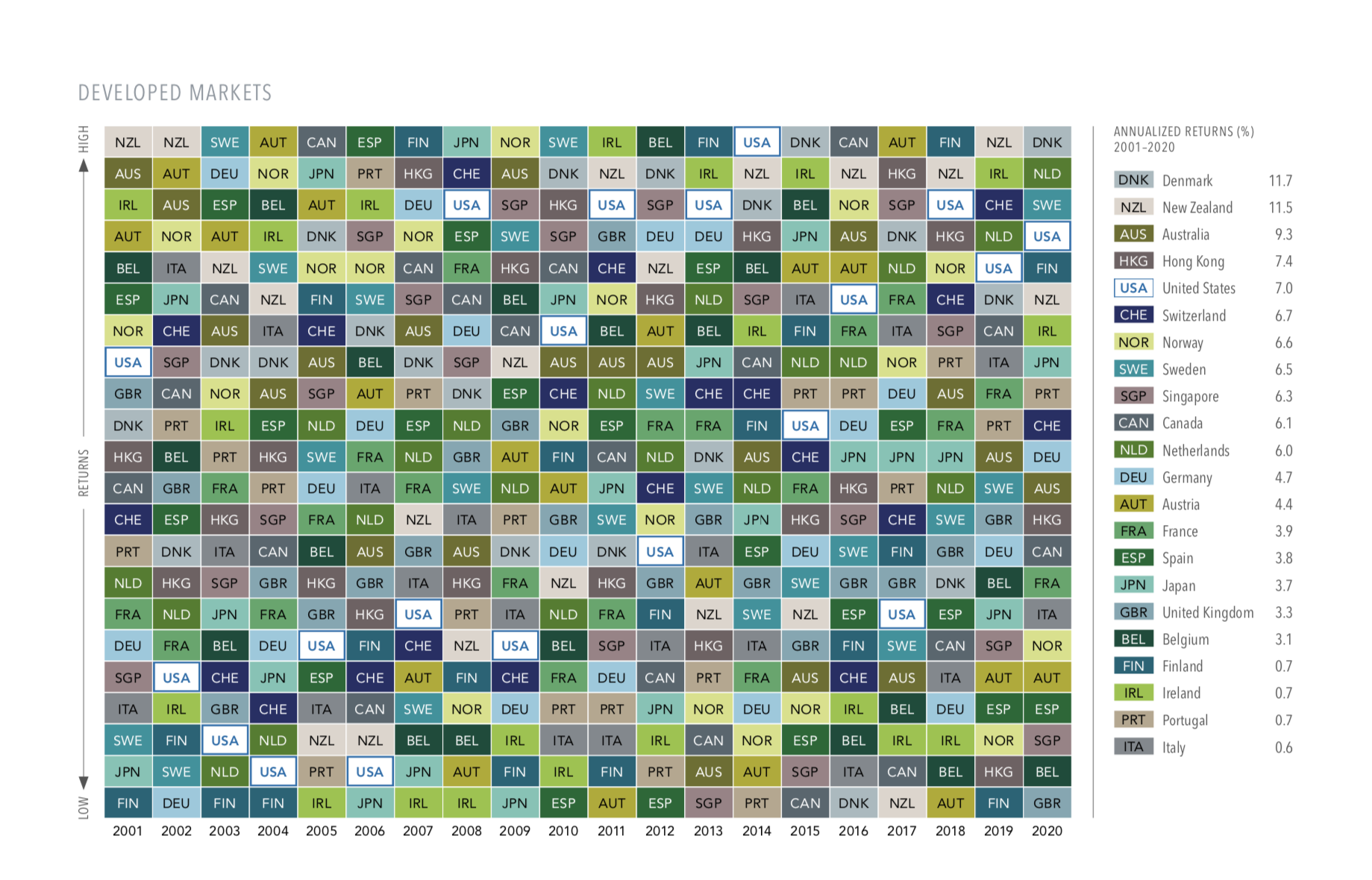

It is difficult to predict future returns by looking at the past, as shown by the performance of global markets since 2001.

- This table powerfully demonstrates the randomness of global equity returns.

It illustrates 20 years of annual returns in 22 developed markets. Each color represents a different country. Each column is sorted top down, from the highest-performing country to the lowest. - The scattered colors suggest it is hard to predict which country will outperform from

one year to the next. Austria, for example, posted the highest developed market return in 2017 but the lowest the next year. - Investors holding equities from markets around the world can have a more consistent investment experience, with higher returns in one market helping offset lower returns elsewhere.

- Past performance is no guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

- In USD. MSCI country indices (net dividends) for each country listed. Does not include Israel, which MSCI classified as an emerging market prior to May 2010. MSCI data © MSCI 2021, all rights reserved.

- Information provided by Dimensional Fund Advisors.